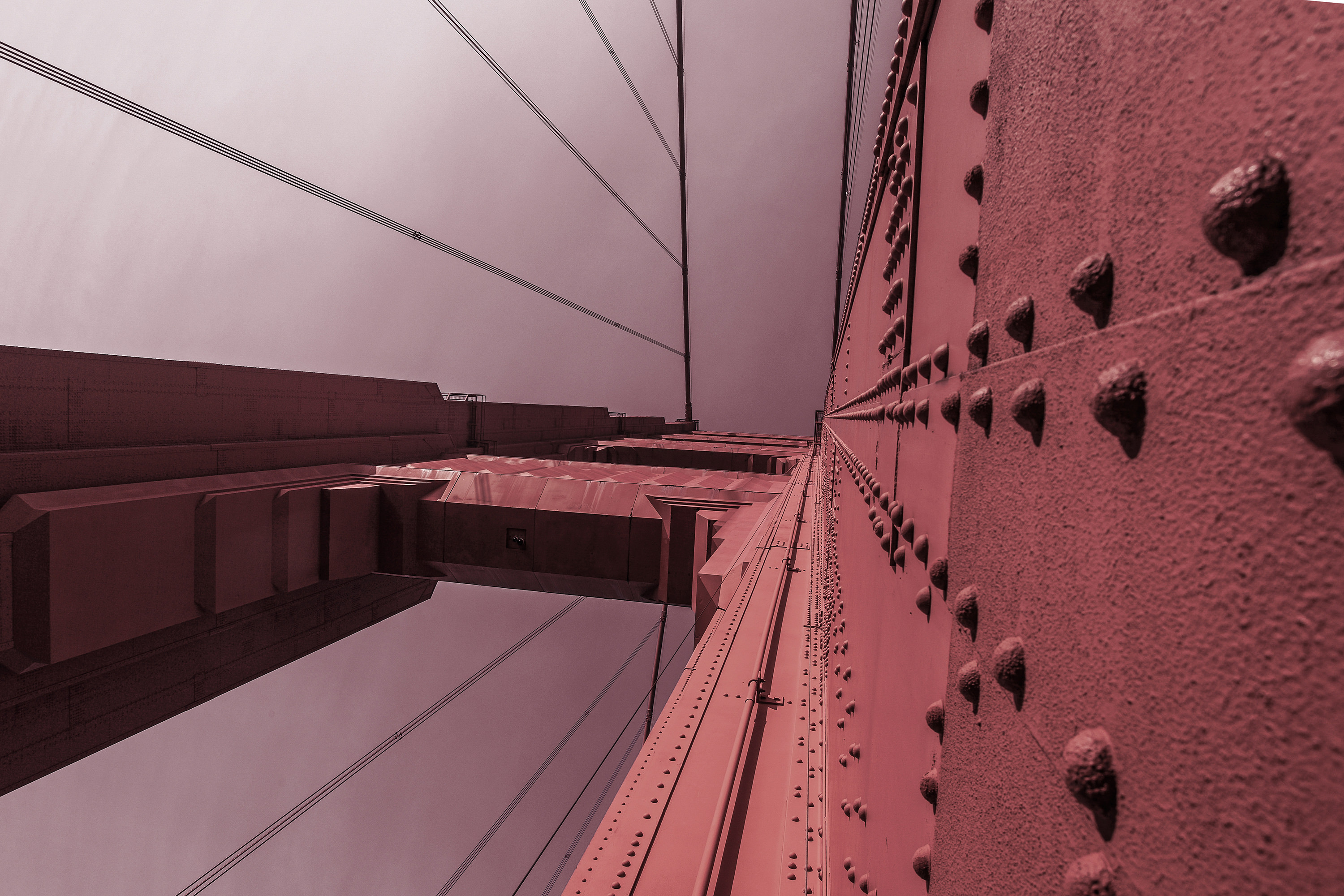

Sparring partner for corporate governance – building bridges between stakeholders to shape the future

Overview

It is becoming more complex for investors, boards of directors, and executive management to stay agile in the market and navigate their organizations through uncertain and dynamic times. Today, tried-and-tested business models are suddenly disrupted, markets and competition are becoming more digital and global, and the interests of various stakeholders often diverge.

Good corporate governance becomes increasingly important for building trust. It is not only important what companies do but also how and why they do it. Company culture, in particular the tone at the top, strongly influences governance to maximize performance excellence, to mitigate risks, and to take advantage of opportunities.

At 2bridge, we act as an independent sparring partner for medium to large listed and family-owned companies. Our services build on over 25 years of international experience, insights and leadership. We support investors, boards of directors and executive management to tailor their organizations’ corporate governance to the changing environment and to stay fit for the future.

“You can either react to change, embrace change or create change”

Bobby Umar

Leadership speaker

Our services

Today’s rapidly changing environment requires companies to adjust their corporate governance to stay agile for the future. 2bridge supports investors, board members and executive management to address questions such as:

- How do the rapidly changing market conditions influence the appropriate governance of your organization?

- How do we bridge differences and align the interests of various stakeholders in the best interest of the company?

- What competences and diversity do the board of directors and management team need to be ready for the future?

- Are board oversight and executive management engagement encouraging, demanding and allowing progress as well as robust enough to ensure compliance is upheld and risks identified and minimized?

We support companies in tailoring and realizing benefits of good corporate governance to:

- build trust and strengthen their reputation with all stakeholders

- ensure appropriate checks and balances are in place to mitigate risks and take advantage of opportunities

- increase transparency

- improve efficiency

2bridge strives for continuous improvement and thought leadership in corporate governance, and our services include:

- acting as an independent sparring partner for investors, board members and executive management

- board memberships in listed and privately held companies

- lectures and workshops

We focus on medium to large listed and family-owned companies in industries we are passionate about and where we have extensive international experience, namely:

- technology

- retail and consumer

- wholesale

- industrial production

- professional services

“Important to stay agile for the future are a vision, hard work, resilience and diversity“

Cornelia Ritz Bossicard

Managing Partner

About us

Cornelia Ritz Bossicard founded the corporate governance advisory boutique 2bridge AG in 2016. She is Chairwoman of the Board of Directors of IVF Hartmann and member of the Boards of Audemars Piguet, Migros-Genossenschafts-Bund, Confiseur Läderach Holding AG, and ETH Board. She is a seasoned Chairwoman and member of Audit Committees (including compliance, risk, cyber resilience and sustainability) as well as Nomination and Compensation Committees. She is the president of the foundation board of the Cäsar Ritz Foundation Niederwald, is a member of the Board of the Foundation Swiss GAAP FER, serves on the Board of Swiss-American Society and is a guest lecturer at various business schools for strategy, corporate governance and finance.

From 2018 to 2024, she was the president of swissVR, one of the leading network organizations for Board members in Switzerland. During that time she shaped and developed the organization to become a Swiss wide recognized network for Board members and doubled the membership base, organzied nationwide events and co-authored over 25 publications. She was awarded honorary membership for her outstanding services.

From 2015 to 2024, she acted as non-executive director for Ferguson Finance (Switzerland) AG. From 2014 to 2020, she served on the Board of Directors and as Audit Committee Chair of Valora Holding AG. Prior she had worked as an audit director and senior advisor with one of the Big Four accounting firms, both in Switzerland and the Silicon Valley, USA. Cornelia has over 30 years of international experience as top rated Director and senior advisor to executives and board members of companies ranging from start-ups to multibillion-dollar multinationals in the technology, industrial products, retail and consumer, wholesale, and professional services industries.

Her educational background includes studying Business Administration at HEC Lausanne, Switzerland, and the Freie Universität Berlin, Germany, and obtaining a Master of Science in Business Administration. In addition, she is qualified as both a Swiss Certified Accountant and a US Certified Public Accountant. She prioritizes continuous learning by regularly participating in board of directors training and pursuing ongoing education at various business schools, including IMD and INSEAD. She is fluent in German (mother tongue), English, and French, and she also speaks Italian.

OUR VALUES

At 2bridge we value

- Teamwork: The best solutions come from working together as a team. Effective teamwork requires respect, sharing, and accountability.

- Leadership: Motivated people lead organizations to their success. Leadership demands vision, resilience, and integrity.

- Agility: Staying agile in uncertain and dynamic times is key to success. Diversity, hard work, and continuous learning are key to staying agile for the future.

NETWORK

Being connected is important for our clients and us. That’s the reason 2bridge collaborates with a strong network of highly experienced experts and why we are members or supporters of a number of associations and organizations, including:

- swissVR (www.swissvr.ch)

- Swiss Institute of Directors (www.siod.ch), which is part of the Global Network of Director Institutes (GNDI) (www.gndi.org)

- Women Corporate Directors (www.womencorporatedirectors.org)

- Swiss-American Society (www.swiss-am.net)

- Swiss American Chamber of Commerce (www.amcham.ch)

- Schweizerische Management Gesellschaft (SMG) (smg.ch)

- EXPERTsuisse: The Swiss Expert Association for Audit, Tax and Fiduciary (www.expertsuisse.ch)

- American Institute of CPAs (AICPA) (www.aicpa.org)

”The most dangerous phrase in the language is, 'We’ve always done it this way'“

Grace Hopper

Inventor of the first compiler for a computer programming language

impulse

Publications

Here is a selection of publications by, with, or about 2bridge and Cornelia Ritz Bossicard.

2024

Women in Business TOP 100, Women in Business, October 2024

Sustainability and the Board – here to stay / Nachhaltigkeit im Verwaltungsrat – gekommen, um zu bleiben / La durabilité, un thème désormais incontournable pour les conseils d’administration, swissVR Monitor I/2024, swissVR / Deloitte / Hochschule Luzern (Cornelia Ritz Bossicard, Reto Savoia, Mirjam Durrer, Daniel Laude), February 2024

swissVR Monitor: Swiss companies struggling with sustainability / swissVR Monitor : les entreprises aux prises avec le développement durable, swissVR / Deloitte / Hochschule Luzern, February 2024

2023

The role of boards in Switzerland and Germany in an increasingly changing business environment, Sherpany - The Agenda Podcast (Cornelia Ritz Bossicard, Ingo Nothoff), November 2023

Cyber resilience - increasingly important for Boards / Cyber-Resilienz – Steigende Bedeutung für Verwaltungsräte / La cyberrésilience – une importance croissante pour les conseils d’administration, swissVR Monitor II/2023, swissVR / Deloitte / Hochschule Luzern (Cornelia Ritz Bossicard, Reto Savoia, Mirjam Durrer, Daniel Laude), September 2023

Cyber resilience – board members are aware of the risks, but action is required with regard to crisis prevention and reporting / Cyber-Angriffe: Verwaltungsräte sehen Risiken, doch bei Krisenvorsorge und Reporting besteht Handlungsbedarf, swissVR / Deloitte / Hochschule Luzern, September 2023

Ethik und Integrität im Verwaltungsrat / Ethique et intégrité au sein du conseil d'administration, swissVR Leitfaden I/2023 (Felix Buschor, Mirjam Durrer, Martin Brasser), April 2023

Board remuneration / Vergütung von Verwaltungsratsmitgliedern / La rémunération des membres de conseils d'administration, swissVR Monitor I/2023, swissVR / Deloitte / Hochschule Luzern (Cornelia Ritz Bossicard, Reto Savoia, Christoph Lengwiler, Daniel Laude), February 2023

Boardroom pay: duties are increasingly time-consuming, but remuneration is hardly rising, swissVR / Deloitte / Hochschule Luzern, February 2023

Verwaltungsräte sind die obersten Führungsgremien der Schweizer Hotellerie - Wie die zentralen Gremien zusammengesetzt sind, zeigt die Auswertung der htr hotelrevue, htr hotelrevue, Mischa Stünzi, Februar 2023

2022

Impulse for Board members: Verantwortungsvolle digitale Transformation / Transformation numérique responsable, swissVR Impulse II/2022 (Cornelia Ritz Bossicard, Cornelia Diethelm, Orlando Budelacci, Christoph Lengwiler), November 2022

On boards of directors diversity is essential, SWI - swissInfo.ch, Philippe Monnier, October 2022

Ogni azienda dovrebbe avere la libertà di scegliere la diversità che più le si addice / Empresas devem ter liberdade de escolher a diversidade, SWI - swissInfo.ch, Philippe Monnier, October 2022

Chaque entreprise devrait avoir la liberté de choisir la diversité qui lui convient le mieux, SWI - swissInfo.ch, Philippe Monnier, September 2022

So schafft man es in einen Verwaltungsrat, SWI - swissInfo.ch, Philippe Monnier, September 2022

Geopolitical developments – a challenge but also an opportunity / Geopolitische Entwicklungen – Herausforderung und Chance zugleich / Les développements géopolitiques – un défi et une opportunité, swissVR Monitor II/2022, swissVR / Deloitte / Hochschule Luzern (Cornelia Ritz Bossicard, Reto Savoia, Christoph Lengwiler, Daniel Laude), August 2022

Geopolitik: Schweizer Unternehmen sind gefordert, swissVR / Deloitte / Hochschule Luzern, August 2022

Normalität ist das nicht. In den Verwaltungsräten ist nach der Pandemie keine Ruhe eingekehrt. Risiko- und Talentmanagement dominieren die Agenda, Finanz und Wirtschaft, Juli 2022

Impulse for Board members: Innovationsfähigkeit für die Zukunft / Capacité d'innovation pour l'avenir, swissVR Impulse I/2022 (Cornelia Ritz Bossicard, Christoph Lengwiler, Erich Obrist, Daniel Portmann), July 2022

La pénurie de main-d’oeuvre qualifiée est considérée comme une menace pour la capacité d’innovation, allnews - la finance suisse dans l'e-media, mars 2022

Schweizer Verwaltungsräte sehen Innovationsfähigkeit wegen Fachkräftemangel in Gefahr / La pénurie de main-d’oeuvre qualifiée est considérée comme une menace pour la capacité d’innovation, swissVR / Deloitte / Hochschule Luzern, März 2022

Innovation - skilled employees are in demand / Innovation - qualifzierte Fachkräfte sind gefragt / Innovation: du personnel qualifié est demandé, swissVR Monitor I/2022, swissVR / Deloitte / Hochschule Luzern (Cornelia Ritz Bossicard, Reto Savoia, Christoph Lengwiler, Daniel Laude), March 2022

2021

Impulse for Board of Directors for dealing with conflicts of interest / Umgang des Verwaltungsrats mit Interessenkonflikten / Gestion des conflits d'intérêts par le conseil d'administration, swissVR Impulse III/2021 (Cornelia Ritz Bossicard, Jörg Walther, Josianne Magnin), December 2021

Impulse for Board members: Data as an Asset / Daten als Vermögenswerte / Les données, ce bien précieux, swissVR Impulse II/2021 (Cornelia Ritz Bossicard, Giulia Fitzpatrick), November 2021

Warum Familienunternehmen auf die Diversität von Verwaltungsratsgremien achten sollten, welche Fähigkeiten und Kompetenzen in der strategischen Führung nötig sind und wie sich ein Verwaltungsrat zukunftsfit hält, PwC Studie - Zeit, das Blatt zu wenden (S. 21 – 22), September 2021

How Board of Directors evaluate their work / Wie Verwaltungsräte ihre Arbeit evaluieren / Comment les conseils d'administration évaluent leur travail, swissVR Monitor II/2021, swissVR / Deloitte / Hochschule Luzern (Cornelia Ritz Bossicard, Reto Savoia, Christoph Lengwiler, Daniel Laude), August 2021

Conseils aux membres des Conseils d'Administration des PME: obligations du CA en cas de menace d’insolvabilité, de perte en capital ou de surendettement, Guide swissVR I/2021 (Cornelia Ritz Bossicard, Jörg Walther, Josianne Magnin), Juillet 2021

Impuls für KMU-Verwaltungsräte: Pflichten des VR bei drohender Zahlungsunfähigkeit, Kapitalverlust oder Überschuldung, swissVR Impuls I/2021 (Cornelia Ritz Bossicard, Jörg Walther, Josianne Magnin), Juli 2021

Die postpandemische Normalität, Trends bei Vergütung und Rekrutierung von Verwaltungsräten nach der Krise, Finanz und Wirtschaft, Juli 2021

Marktwert von Mitarbeitenden, HR Today, Juni 2021

Corporate Governance: Fünf Fragen an fünf Corporate Governance-Experten, Expert Focus, EXPERTsuisse, Mai 2021

Gouvernance d'entreprise: cinq experts, cinq questions, Expert Focus, EXPERTsuisse, mai 2021

Changer de CFO avec succès, l'Agefi Indices, mai 2021

Verwaltungsräte brauchen eine Talentstrategie, Finanz und Wirtschaft, März 2021

Erfolgsfaktor Mensch – Talentmanagement: Schweizer Unternehmen rechnen mit Schwierigkeiten beim Rekrutieren hoch qualifizierter Mitarbeitender, swissVR / Deloitte / Hochschule Luzern, Februar 2021

The human success factor - future of talent management / Erfolgsfaktor Mensch - Talentmanagement der Zukunft / L'avenir de la gestion des talents: l'humain, facteur de réussite, swissVR Monitor I/2021, swissVR / Deloitte / Hochschule Luzern (Cornelia Ritz Bossicard, Reto Savoia, Christoph Lengwiler, Daniel Laude), February 2021

2020

Stolperstein Entschädigung: VR-Honorare und Recht, Unternehmerzeitung (Myriam Minnig, Cornelia Ritz Bossicard), Dezember 2020

Vorsorgepflicht des Verwaltungsrats / La prévoyance obligatoire pour les conseils d'administration, Schweizer Personalvorsorge / Prévoyance Professionelle Suisse (Myriam Minnig, Cornelia Ritz Bossicard), September 2020

VR Praxis Umfrage und Prognosen: VR beurteilen eigene Geschäftsaussichten optimistischer als Konjunktur - wird Digitalisierungsschub nun genutzt?, UnternehmerZeitung, September 2020

Was Verwaltungsräte aus der Krise lernen, Finanz und Wirtschaft (FuW), August 2020

Impuls für KMU-Verwaltungsräte: Cyber-Resilienz, swissVR Impuls III/2020 (Cornelia Ritz Bossicard, Matthias Bossardt), August 2020

Conseils aux CA des PME: cyber-résilience, Guide swissVR III/2020 (Cornelia Ritz Bossicard, Matthias Bossardt), août 2020

Impuls für KMU-Verwaltungsräte: Tipps für die COVID-19-Krise - Teil 2, swissVR Impuls II/2020 (Cornelia Ritz Bossicard, Marius Fuchs), Mai 2020

Conseil aux CA des PME en lien avec la crise du COVID-19 - part 2, Guide swissVR II/2020 (Cornelia Ritz Bossicard, Marius Fuchs), mai 2020

Tipps für KMU zum Krisenmanagement, swissVR Impuls I/2020 (Cornelia Ritz Bossicard, Marius Fuchs), März 2020

Conseils pour PME en matière de gestion de crise, Guide swissVR (Cornelia Ritz Bossicard, Marius Fuchs), mars 2020

La nécessité d'une responsabilité sociale, AGEFI, mars 2020

Soziale Verantwortung notwendig. Verwaltungsräte sehen den Nutzen gesellschaftlicher Verantwortung. Themenführung durch VR ist für die Umsetzung nötig. Finanz und Wirtschaft, Februar 2020

Gesellschaftliche Verantwortung ja, aber nicht auf Kosten der Unternehmensgewinne, Organisator März 2020

Les entreprises suisses ne définissent pas systématiquement des objectifs, allnews mars 2020

Social responsibilty necessary – Why Corporate Social Responsibility is an opportunity for companies to stand out, en24, March 2020

2019

Swiss-American Society, Zurich - 100 Years of History and Still Going Strong, Swiss-American Chamber of Commerce, Yearbook 2019/2020

Swiss boards pressing ahead with digitalisation – high costs and ethical issues though pose challenges, swissVR, Deloitte, HSLU, August 2019

Verwaltungsräte als Treiber der Digitalisierung, Organisator, August 2019

Les conseils d'administration investissent dans la numérisation au détriment des profits, AGEFI, August 2019

Interview mit Loomion über swissVR, swissVR Monitor und die Hauptthemen für swissVR in 2019, Board-Portal-Software.de, July 2019

The obstacles and opportunities for an inclusive digital world, Sherpany Insighty

The challenges of digitalisation and the board's role in fostering change management, Sherpany Insights, July 2019

Unternehmenskultur als Erfolgsfaktor / Corporate culture as a success factor, The Reporting Times N°14, Mai 2019

Offene Unternehmenskultur ist für Verwaltungsräte wichtiger für den Erfolg als Compliance und Risikomanagement, Organisator, Februar 2019

Digitalisierung ist Top-Thema der Schweizer Verwaltungsräte, netzwoche, Februar 2019

Der Mensch im digitalen Zeitalter, seniorweb.ch, Februar 2019

Warum Unternehmenskultur zählt: Für Verwaltungsräte hat das Thema grosse Bedeutung - als Wettbewerbsvorteil und als Erfolgsfaktor / Why corporate culture matters, Finanz und Wirtschaft, Februar 2019

Warum Sie digitale Kompetenz im Verwaltungsrat dringend brauchen, InnoActvide, Januar 2019

2018

Non-executive directors – responsibility means trusting and questioning, PwC Disclose September 2018

Verwaltungsräte – Verantworten heisst vertrauen und hinterfragen, PwC Disclose September 2018

Les administrateurs – la responsabilité repose sur la confiance et la remise en question, PwC Disclose September 2018

Verwaltungsräte erhalten Lohn meist als Pauschale, swissVR, Deloitte, HSLU, 26. August 2018

Cornelia Ritz Bossicard, President of swissVR, comments in the Sonntagszeitung on collective failures on the boards of directors, Sonntagszeitung, 1. Juli 2018

2017

Finance Monthly speaks to Cornelia Ritz Bossicard about her company 2bridge AG and current trends in corporate governance, finance-monthly.com, November 2017 Edition

Die einsamen Präsidentinnen, Sonntagszeitung, 10 September 2017

In welchen Firmen Frauen im Verwaltungsrat sitzen, Tagesanzeiger, 9 September 2017

En Suisse, seules 5% de femmes sont présidentes d'un conseil d'administriation, Le Matin Dimanche, 10 September 2017

swissVR Monitor

The swissVR Monitor is a survey conducted jointly by swissVR (with Cornelia Ritz Bossicard as its president from 2018 to 2024), Deloitte and the Lucerne University of Applied Sciences and Arts. The bi-yearly survey gauges the attitudes of around 400 board members in Switzerland towards current matters of relevance to boards. The findings are an accurate reflection of their attitudes to the economy and the outlook for business and relevant areas of their own role.

swissVR Monitor I/2024 - Sustainability and the Board – here to stay

Sustainability - Swiss companies are clearly moving towards a more sustainable future, but the headwind they are experiencing appears to be stronger than expected. The topic has become increasingly important over the past few years, a trend that looks likely to continue. In 2024, for example, many listed companies in Switzerland will be addressing major new sustainability challenges: they are now under a new statutory obligation to report in detail on the progress they are making towards their sustainability goals – an important step towards greater

transparency and accountability. Non-listed companies, too, are facing growing demands for greater sustainability from stakeholder groups. All Boards therefore need to address this issue and have a clear understanding of their own role and obligations in the area of sustainability. This edition of swissVR Monitor considers aspects such as the major sustainability issues confronting businesses, the measures they need to take, the obstacles they face, and the nature of the debate within their Boards.

Some key findings:

- Sustainability issues will become markedly more important to companies: 66% expect sustainability issues to become more important to companies over the next three years.

- External stakeholders challenge companies over sustainability issues: 59% of Board members believe regulation is the greatest factor shaping sustainability.

- Obstacles to greater sustainability: 60% of companies report that it is difficult to measure their own environmental impact.

- Most Boards discuss sustainability: 85% of Boards have discussed the issue of sustainability over the past 12 months.

Read more in swissVR Monitor I/2024: Sustainability and the Board – here to stay / Nachhaltigkeit im Verwaltungsrat – gekommen, um zu bleiben / La durabilité, un thème désormais incontournable pour les conseils d’administration, swissVR Monitor I/2024, swissVR / Deloitte / Hochschule Luzern (Cornelia Ritz Bossicard, Reto Savoia, Mirjam Durrer, Daniel Laude), February 2024

swissVR Monitor II/2023 - Cyber resilience - increasingly important for Boards

Cyber resilience – board members are aware of the risks, but action is required with regard to crisis prevention and reporting: Cyber-attacks are affecting the Swiss economy more than ever. One in two large companies have already fallen victim to them, and in many cases such incidents result in a business interruption. The 14th edition of swissVR Monitor shows that, although awareness of the risks is increasing, many companies lack a clearly formulated cyber strategy. They practise for emergencies only rarely, and reporting to the board of directors by the management team also needs to improve.

Some key findings:

- Cyber attacks can have very serious consequences for companies: 42% of cyber victims say an attack has disrupted their company’s operations.

- Cyber resilience now markedly more important to companies: 55% of Board members think the importance of cyber resilience has increased significantly over the last three years.

- Regular cyber reporting to the Board could be improved: 56% of Boards receive reports from management on cyber-related incidents within the company.

Read more in swissVR Monitor II/2023: Cyber resilience - increasingly important for Boards / Cyber-Resilienz – Steigende Bedeutung für Verwaltungsräte / La cyberrésilience – une importance croissante pour les conseils d’administration, swissVR Monitor II/2023, swissVR / Deloitte / Hochschule Luzern (Cornelia Ritz Bossicard, Reto Savoia, Mirjam Durrer, Daniel Laude), September 2023

swissVR Monitor I/2023 - Board remuneration

Remuneration for Board members is complex, with several issues to consider. It is influenced by a number of different factors, including time spent on Board activities, the responsibility and risk involved in a Board mandate, the requirements of Board members (specialist expertise, experience and networks), and market comparability. Both internal and external stakeholders are increasingly concerned with the level and appropriateness of Board remuneration. For these reasons, Boards should reassess their company’s remuneration structures from time to time.

Some key findings:

- Time spent the main criterion for determining Board remuneration: 74% think that time spent on Board activities is a major criterion for determining Board remuneration.

- Wide diversity of Board remuneration: 42% of Board members report being paid between CHF 15,000 and CHF 50,000.

- Flat-rate payments the most common remuneration model: 61% receive only a flat-rate payment.

Read more in swissVR Monitor I/2023: Board remuneration / Vergütung von Verwaltungsratsmitgliedern / La rémunération des membres de conseils d'administration, swissVR Monitor I/2023, swissVR / Deloitte / Hochschule Luzern (Cornelia Ritz Bossicard, Reto Savoia, Christoph Lengwiler, Mirjam Durrer, Daniel Laude), February 2023

swissVR Monitor II/2022 - Geopolitical developments - a challenge but also an opportunity

With the current geopolitical developments, the question is not if but how companies and Board of Directors are dealing with the impact of geopolitical risks and opportunities.

Some key findings:

- Impact from geopolitical risks but few measures to identify, assess and tackle risks: 59% rate the impact on their company from geopolitical risks over the next 12 months as high or very high.

- Geopolitical gamblers form largest group of Boards: 33% of Boards can be classified as geopolitical gamblers.

- Geopolitical developments seen as a challenge but also an opportunity: 77% see geopolitical developments as an opportunity for their company.

Read more in swissVR Monitor II/2022: Geopolitical developments – a challenge but also an opportunity / Geopolitische Entwicklungen – Herausforderung und Chance zugleich / Les développements géopolitiques – un défi et une opportunité, swissVR Monitor II/2022, swissVR / Deloitte / Hochschule Luzern (Cornelia Ritz Bossicard, Reto Savoia, Christoph Lengwiler, Daniel Laude), August 2022

swissVR Monitor I/2022: Innovation – skilled employees are in demand

The ability of companies to innovate is crucial to their growth and competitiveness. swissVR Monitor I/2022 therefore focuses on this topic, highlighting the role that Boards of Directors play in companies’ management of innovation. It finds that while innovation is central to their work, Boards delegate its implementation to the senior management team. Board members see availability of skilled labour and adequate levels of know-how as crucial success factors in making – and keeping – companies innovative. They also identify room for improvement in both the internal and external conditions for innovation.

Some key findings:

- Wide range of innovation activities: 64% of companies report that service innovation is the main focus of their innovation activities.

- Innovation is a top priority for Boards: 91% say that their Board engages with the innovation process within the company.

- Skilled employees seen as key to innovation: 57% see room for improvement in the availability of skilled labour in relation to innovation activities.

Read more in swissVR Monitor I/2022: Innovation - skilled employees are in demand / Innovation - qualifzierte Fachkräfte sind gefragt / Innovation: du personnel qualifié est demandé, swissVR Monitor I/2022, swissVR / Deloitte / Hochschule Luzern, March 2022

swissVR Monitor II/2021: How Boards of Directors evaluate their work

Amid the routine, content-driven work of any Board of Directors, it is all too easy to forget to pause and reflect on how well the Board is functioning and what improvements could be made. swissVR Monitor II/2021 therefore looks at how Boards evaluate their own work. The overwhelming majority of Boards do carry out such evaluations and use them as the basis for improvements. The picture in relation to Board evaluation is positive overall, although there is some room for improvement, for example in relation to implementing measures to optimise the way the Board works.

Some key findings:

- Vast majority of Boards self-evaluate: 80% say that their Board evaluates its own work.

- Wide range of topics for Board evaluations: 50% focus on the Board’s performance during evaluation.

- Very positive assessment of the Board’s work, but also challenges: 98% see themselves as sparring partners and as providing constructive criticism to management.

Read more in swissVR Monitor II/2021: How Board of Directors evaluate their work / Wie Verwaltungsräte ihre Arbeit evaluieren / Comment les conseils d'administration évaluent leur travail, swissVR Monitor II/2021, swissVR / Deloitte / Hochschule Luzern, August 2021

swissVR Monitor I/2021: The human success factor - future of talent management

As they look to the future, companies will have to tackle a number of different human resources challenges, including possible skills shortages and the impact of demographic change. As swissVR Monitor I/2021 shows, Board members believe that their company is equipped in general terms to tackle the challenges posed by the future of talent management. However, they also identify room for improvement in some areas of talent management, particularly providing initial and continuing training and skills development for their employees and addressing the diversity and team-working skills of senior management.

Some key findings:

- Need for action identified in some areas of talent management: 59% assume that it will continue to be difficult to recruit highly skilled staff.

- Personnel and skills development underpin talent management: 87% intend to strengthen employees’ sense of responsibility and reward entrepreneurial thinking.

- Wide range of key managerial competencies: 66% cite communication skills and persuasiveness as the most important competencies for managers.

Read more in swissVR Monitor I/2021: The human success factor - future of talent management / Erfolgsfaktor Mensch - Talentmanagement der Zukunft / L'avenir de la gestion des talents: l'humain, facteur de réussite, swissVR Monitor I/2021, swissVR / Deloitte / Hochschule Luzern, February 2021

swissVR Monitor II/2020: The Board of Directors’ perspective on COVID-19: Learning the lessons for the next crisis

In the wake of the COVID-19 crisis, members of Boards of Directors rate the outlook for the Swiss economy and for their sector as very negative. When the crisis started, most companies had a crisis management organisation in place, but few had planned for a pandemic or carried out exercises with the crisis management team. Major differences emerge between sectors and companies of differing size in terms of how businesses have managed the crisis and the measures they have taken. The lessons Boards have learned from the crisis range from the need for more digitalisation, greater resilience and new employment models to acknowledgement of the importance of working with scenarios and making better provision for planning liquidity.

swissVR Monitor II/2020 is available in English and German

swissVR Monitor I/2020: Corporate social responsibility: An opportunity to stand out

A large majority of Board members surveyed think corporate social responsibility (CSR) makes a company more attractive, enhances its reputation and creates competitive advantage. They rate the responsibility of companies to their employees and customers, and their responsibility for the ethical conduct of their business as the most important aspects of CSR. However, the strategic planning and systematic and sustainable implementation of CSR remain a major challenge, with many companies perceiving a conflict between the costs and benefits of CSR.

swissVR Monitor I/2020 is available in English and German

swissVR Monitor II/2019: More agile but more complex: the impact of digitalisation on boards and companies

Digitalisation is a priority topic for the boards of directors in Swiss companies: More than four out of five board members see opportunities to create new business and increase sales. However, substantially more than half of them state that they are spending a lot of money on digital transformation, which is reducing profitability. The new edition of swissVR Monitor clearly shows that the digitalisation of organisations is being driven from the top. Nonetheless, one third of the board members surveyed feel that progress was too slow, and four out of five of them feel they lack the relevant know-how. Board members also believe that digitalisation elicits an elevated security risk such as cyber-attacks. Whether boards pay enough attention to the ethical questions of digitalisation is debatable.

swissVR Monitor II/2019 is available in English and German

swissVR Monitor I/2019: Corporate culture as a competitive advantage

A strong and open corporate culture is more than just a competitive advantage: Swiss board members view it as one of the key drivers of business success. According to the latest swissVR Monitor, they rate culture among their top 10 issues to watch – even placing it above compliance and risk management. As they themselves are not involved in the day-to-day business, board members primarily rely on employee surveys and site visits to help them evaluate the culture within their own company. According to the swissVR Monitor survey, the behaviour and communication style at top management level has the biggest impact on corporate culture – for better or for worse.

swissVR Monitor I/2019 is available in English and German

swissVR Monitor II/2018: Remuneration of Board members

Two-thirds of Board members believe that the time they spend on their mandate is a key criterion for determining their remuneration. And, just under half believe that the scope of the responsibility and the risk they take should play a part in determining their remuneration. The findings of swissVR Monitor II/2018 also show that there is wide variation between Board members in both time commitment and remuneration.

The most important results of this swissVR Monitor are discussed by Cornelia Ritz Bossicard, President of swissVR, and Reto Savoia, Deputy CEO of Deloitte Switzerland in this video .

swissVR Monitor II/2018 is available in English and German.

Previous swissVR Monitors are available on the swissVR website .

Speeches & Workshops (upcoming events)

Lucerne University of Applied Sciences and Arts, Institut für Finanzdienstleistungen IFZ

CAS Verwaltungsrat / CAS Board of Directors: Fachracht / Member of Advisory Council CAS Board of Directors / Coach / Lecturer, ongoing

Einführungsseminar für Verwaltungsräte: Erfolgreiche Arbeit im Verwaltungsrat – Tipps für die Verwaltungsratstätigkeit / Board effectiveness

Executive MBA: Corporate Governance

University of St. Gallen (HSG)

Strategische Geschäftsführung für CEOs und Verwaltungsräte: Strategische Geschäftsführung, Entwicklungen und zukünftige Herausforderungen als Verwaltungsrat / Strategic leadership, developments and future challenges for Board of Directors

The Boardroom

The Boardroom: Board Governance Workshop

Speeches & Workshops (past events)

EXPERTsuisse

Seminar Leistung und Entgelt des Verwaltungsrats: Fettnäpfchen und Stolperfallen in Bezug auf Sozialversicherungen und Steuern

Seminar Aktuelle Themen zum Internen Audit: Anforderungen an die Interne Revision seitens einer modernen Corporate Governance / Internal Audit

EXPERTsuisse Jahrestagung 2021 zu Corporate Governance

Rochester-Bern Executive Programs, University of Rochester / Universität Bern

CAS für Verwaltungsräte Rochester-Bern Executive Programs: Successful Boards - no coincidence

CAS für Verwaltungsräte Rochester-Bern Executive Programs: Board evaluation

Lucerne University of Applied Sciences and Arts, Institut für Finanzdienstleistungen IFZ

Einführungsseminar für Verwaltungsräte: Erfolgreiche Arbeit im Verwaltungsrat - Tipps für die Verwaltungsratstätigkeit / Board effectiveness

CAS Verwaltungsrat: Member of Advisory Councel CAS Board of Directors, Coach

Executive MBA: Corporate Governance

Seminar für Sekretäre des Verwaltungsrates: Arbeitsweise und Wirksamkeit von Audit Committees / Audit Committee effectiveness

University of St. Gallen (HSG)

EMBA HSG Homecoming "Be Human - Stay Human": Board Composition

Strategische Geschäftsführung für CEOs und Verwaltungsräte: Entwicklungen und zukünftige Herausforderungen als Verwaltungsrat / Developments and future challenges for Board of Directors

University of Zurich

Bachelor Business Administration: Introduction to Auditing - Board insights

The Boardroom

The Boardroom: Board Governance Workshop

The Boardroom: Board evaluation

The Boardroom: Strategy Workshop

The Boardroom: Board simulation Workshop

Various

Danish-Swiss Chamber of Commerce: Panel discussion on "being and becoming a Board member"

IMD Alumni Club of Switzerland, Zurich: Panel discussion on "being and becoming a Board member: chances, risks and opportunities"

Institute of Internal Auditing (IIA): IIA Switzerland National Conference 2022, The Boards expections towards Internal Audit

International Corporate Governance Network (ICGN): ICGN Annual Conference Milan: Panel discussion on "Fiduciary duty in challenging times"

maxon motor AG: Fabrikgespräch: Führung in der digitalen Welt: was tun - was lassen

Mercury Urval Board & Executive Forum: Erfolg ist kein Zufall / Success is no coincidence

National Association of Corporate Directors (NACD) / LHH ICEO: Demystifying the Board: Unlocking Your Path to Board Service

PwC: Corporate Reporting event: Corporate reporting: the role and the view of the board of directors

Schulthess Forum: Neue Zürcher Verwaltungsratskonferenz 2020: Der Verwaltungsrat als Gestaltungsrat

VR-Symposium: Der Verwaltungsrat als Orchester, der Verwaltungsratspräsident als Dirigent / the board of directors as orchestra, the chair of the board as conductor

Wif - Wirtschaftsforum für Frauen: Podiumsdiskussion "Traumjob Verwaltungsrätin"

Women in Business Talk: Verwaltungsratsmandate sind heiss begehrt. Wie kommt Frau da hin?

Wipswiss: Erfolgreiche Verwaltungsrätinnen - kein Zufall

ZfU - Zentrum für Unternehmensführung, International Business School (ZfU): Das Verwaltungsrats-Seminar Advanced: Strategische Neuausrichtungen / Strategic transformations

”Don't find fault, find a remedy“

Henry Ford

Industrialist

Contact

2bridge AG

Hohfurenstrasse 6

CH-8610 Uster

+41 44 941 28 28

info@2bridge.partners